Some student loan forgiveness is tax-free The earned income tax credit (EITC) is a refundable tax credit that assists low and moderate income families.ĥ. It's going to be a challenge for people filing their taxes." 4. "I have been advising people to make sure what you actually received agrees with the IRS Letter 6419. "The challenge is the forms are not matching up exactly with what people have received," says Jamie Hopkins, managing partner of wealth solutions at Carson Group, a financial services firm with over $20 billion of assets under management. It's possible, however, that some taxpayers may have received more than the eligible credit and can find themselves in a position where they need to repay it. Those who received advance payments can use information in Letter 6419 from the IRS to claim the balance. Those who didn't receive advance payments will receive the full credit. Taxpayers who received advance payments in the second half of 2021 will receive the remainder after they file their tax returns. You have to get your new child's information such as Social Security and other data to provide to the IRS. Quick tip: If you had a child born in 2021, you may qualify for a $3,600 child tax credit plus a $1,400 for stimulus payment, since that new baby may not have been paid for last year.

For those whose filing status is single, married filing separately, and head of household, the amount increased by $150 from 2020. Itemizing can be more complicated than taking the standard deduction and is only worth doing if the total amount exceeds the standard deduction. Both reduce the amount of your income that is taxed. When you prepare your taxes, you have the option of taking the standard deduction or itemizing deductions.

9 changes to know for the 2021 tax year 1. Here are some of the key tax changes to keep in mind when preparing your 2021 federal tax return. With the greater complexity, there comes a greater benefit." If you can navigate through the complicated rules, it will have a very positive taxpayer impact. "On the positive side, most of those changes are positive changes for the taxpayer. "The bad news is the tax returns are more complicated this year," says Mark Steber, chief tax information officer at Jackson Hewitt Tax Services. Everything from changes in the standard deduction and tax brackets to pandemic-related tax provisions can affect your return for the 2021 tax year. And every year, some things change, making it even more onerous for the average taxpayer. Preparing your federal taxes can be a daunting task. The FEIE threshold for tax year 2019 was $105,900, for tax year 2020 is $107,600, and for tax year 2021 will be $108,700.By clicking ‘Sign up’, you agree to receive marketing emails from InsiderĪs well as other partner offers and accept our The Foreign Earned Income Exclusion can be claimed by filing Form 2555 with Form 1040.

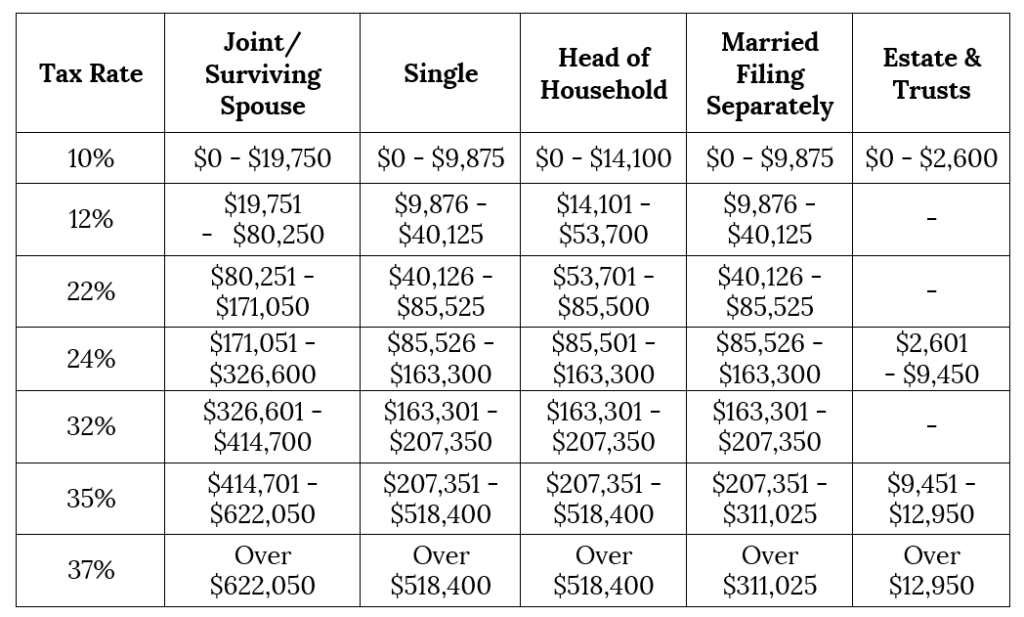

The Foreign Earned Income Exclusion is one of the main provisions that allow expats to reduce or eliminate their US tax bill.Įxpats who qualify by either spending over 330 days outside the US in a 365 day period (which is normally, but not necessarily, the tax year) or who can otherwise prove that they reside abroad can exclude their earned (as opposed to passive) income from US taxation, up to a threshold. The Foreign Earned Income Exclusion threshold It was $12,200 in tax year 2019, and $12,4, while for tax year 2021 it will rise to $12,550 for individuals.The tax year 2021 Standard Deduction amounts for couples filing jointly will be $25,100, and for Heads of Household $18,800. The Standard Deduction is also adjusted for inflation each year. “The IRS has announced the annual inflation adjustments for tax year 2021, including tax rate schedules, tax tables and cost-of-living adjustments.” – Forbes 2019įor joint filers and Head of Household tax year 2021 rates and brackets, see here.

0 kommentar(er)

0 kommentar(er)